New Research: Stricter Abuse of Dominance Provisions Hurt GDP & Job Growth

Over recent years, many of your state legislators have proposed to expand state-level antitrust legislation inspired by the New York Twenty First Century Antitrust Act (S9336), which creates a stricter state-level antitrust regime than the federal antitrust regime for all companies operating in New York State. None of the state bills moved during the most recent legislative sessions, however, there remains significant risk that state legislatures in the future will consider similar legislation.

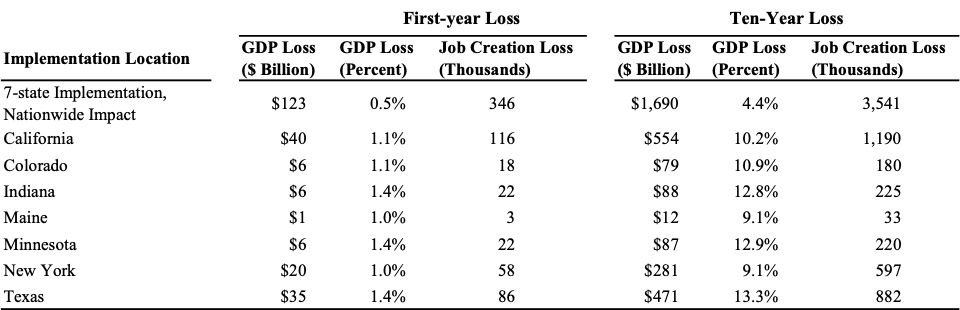

A recent study by the CCIA Research Center examined the economic impacts of the proposed changes in seven subject states (New York, California, Colorado, Indiana, Maine, Minnesota, and Texas), and the ripple effects on the United States. CCIA Research Center found that there would be significant harms to GDP and job growth both in the states proposing such legislation and nationally. If such antitrust legislation were implemented, the U.S. could lose over 340,000 jobs in the first year alone.

Proposed Antitrust Provisions

Several states have considered implementing certain antitrust provisions outlined in S9336. The bill intended to lower the market share threshold for a presumption of dominance to bring more companies under antitrust scrutiny. Companies that have a minimum market share of 40% would be impacted, compared to a market share of 50% and often higher, under the federal Sherman Act. This is problematic in local markets because many smaller businesses that have 40% of a local market would be deemed “dominant” under new state legislation. For example, small grocery retailers like Hannaford, a grocery store in Maine, would be classified as “dominant” when in reality it is a small chain serving a rural community.

The provisions also lowered the bar of intervention and enlarged the set of conduct presumed illegal by “dominant” firms, including conduct that limits the incentive for competitors to compete with each other and prohibits a refusal to deal. For example, if Terry’s grocery store specializes in a distinctive, beloved bread, and Sam’s grocery wants to undercut Terry’s distinctiveness by buying their distinctive bread at the base price and selling it for more. Under this stricter antitrust regime, Terry’s would not be allowed to refuse to deal.

The bill also does not allow the balancing of procompetitive benefits against anticompetitive harm, which deters the adoption of specific practices even when they would boost competition overall and benefit consumers. For example, Terry’s, due to their local position and scale, may be able to negotiate favorable rates with suppliers, giving them a competitive advantage that benefits consumers in lower prices. But if a new grocery opens in the market, Alex’s, they may be unable to negotiate as favorable of a price limiting their expansion opportunities. Consumers still benefit from the lower price negotiated with the suppliers as they get valued goods at a lower price. In this way, imposing state-level “abuse of dominance” provisions risks abusing consumers and harming consumer welfare.

Economic Impacts

CCIA’s Report found that, upon implementing this style of legislation, the seven analyzed states (California, Colorado, Indiana, Maine, Minnesota, New York, and Texas) would likely face dramatic losses to their economies. For example, if California was to implement such a bill, their GDP would be reduced by 1.1%, resulting in reduced job creation of 116,000 in the first year.

Despite targeting large firms with dominant market share, the proposed legislation negatively impacts small and medium-sized businesses as well. A non-trivial share of deterred procompetitive conduct is by small and medium-sized businesses – 4.9% of small business merger and acquisitions (M&A), 28.9% of medium-sized business M&A, and 0.6% of medium-sized business unilateral conduct.

The impacts of this style of legislation don’t stop at the state level. CCIA’s report looked at firms’ decision to engage in certain procompetitive business conduct that could potentially be deterred by provisions in the New York Twenty First Century Act. It found that if implemented in the seven states analyzed, national GDP could be reduced by $123 billion in the first year, which represents a 0.5% GDP loss, costing 346,000 jobs across the country. Over the next decade, these costs could grow significantly. GDP losses could total $1.7 trillion in a decade, a 4.4% decrease in GDP, resulting in 3.5 million fewer jobs created.

Additionally, the report found that given the scale of estimated foregone profits due to overdeterrence by antitrust authorities, there would be a significant reduction in investment and research and development in the billions of dollars each year. This reduction will have harmful impacts on innovation and U.S. technological leadership.

States considering bills like the New York Twenty First Century Act should consider how proposed legislation will increase uncertainty and regulatory risk for a large number of companies, including smaller ones that are not currently considered to be in scope of enforcement under federal law. Many firms will abandon their business practices that led them to growth in the first place.

The over-enforcement will have negative economic consequences for the economy including company growth, company profitability, investment, and overall economic performance of the state and nation. More productive, helpful legislation could be introduced, for example, policies that facilitate the diffusion of technology and know-how, or policies that provide support for effective IP strategies for small and medium companies. Lawmakers should not be focused on eliminating efficiencies of large players, but rather to raise every player’s performance.